Setting up your company file > Set up accounts

Accounts provide a means for grouping similar transactions. For example, if your business pays rent for the use of its premises, you would create a rent account and then allocate all rent payments to that account.

The accounts you use for your business are grouped in an accounts list.

If your accountant or MYOB Approved Partner has provided you with a company file, this task may have been completed for you. In this case, go to Enter account opening balances

When you created your company file, you selected a default accounts list to start with. This list may already have the accounts you need. If not, you can change the list to suit your needs. If you are unsure, ask your accountant which accounts you should create, edit or delete.

Each account is identified by a unique five digit number. The first digit indicates the account’s classification (for example, accounts starting with 1 are asset accounts). The remaining four digits determine its location within the classification. The lower the number, the higher up in the list it appears. For example, account 1-1100 appears above 1-1200.

The accounts list groups accounts into eight classifications—Assets, Liabilities, Equity, Income, Cost of Sales, Expenses, Other Income and Other Expense. Within each account classification there is at least one account type.

|

Asset

(1-xxxx) |

Money in the bank, for example, in a cheque or savings account.

|

|

|

Accounts Receivable

|

Money owed to you by your customers.

|

|

|

Other Current Asset

|

Assets that, if required, can be turned into cash within a year. These may include your term deposits.

|

|

|

Assets which have a long life, for example, buildings, cars and computers. Fixed assets are usually depreciated.

|

||

|

Other assets you own such as loans made to others and goodwill.

|

||

|

Liability

(2-xxxx) |

Repayments required to service credit card debt.

|

|

|

Accounts Payable

|

Money owed by you to your suppliers.

|

|

|

Other Current Liability

|

Money owed by you that is due in less than a year, for example, GST.

|

|

|

Long Term Liability

|

Money owed by you that is due in more than one year, for example, a business loan.

|

|

|

Equity

(3-xxxx) |

The business’s net worth, that is, its assets minus its liabilities. Common equity accounts are current year earnings, retained earnings and shareholders’ equity.

|

|

|

Income

(4-xxxx) |

Revenue from the sale of goods and services.

|

|

|

Cost of Sales

(5-xxxx) |

The direct cost of selling your goods and providing services, for example, purchase costs and freight charges.

|

|

|

Expense

(6-xxxx) |

The day-to-day expenses of running your business, for example, utility bills, employee wages and cleaning.

|

|

|

Other Income

(8-xxxx) |

Other revenues, for example, interest earned on savings and dividends paid from shares.

|

|

|

Other Expense

(9-xxxx) |

Other Expense

|

Other expenses, for example, interest charged.

|

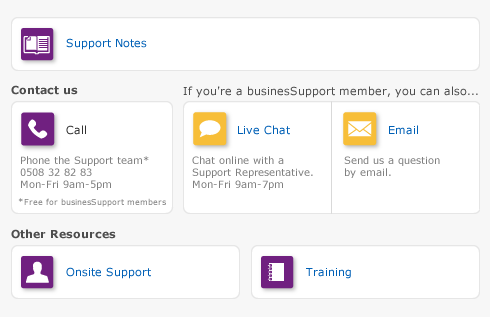

Your accounts list consists of detail accounts (the accounts to which you allocate transactions) and header accounts. Header accounts group related detail accounts to help you organise your accounts list.

For example, you could group your telephone, electricity and gas expense accounts using a Utilities header account. This makes it easier for you to locate the utility expense accounts in the accounts list and to see your combined utility expenses.

You group accounts by indenting the detail accounts located directly below a header account.

|

▪

|

The balance of a header account is the sum of the detail accounts indented directly below it.

|

|

▪

|

You can create up to three header account levels as shown in the example above.

|

How you group your accounts can affect how totals and subtotals are calculated on reports. For more information about how to set up accounts for financial reporting, see Tracking financial information.

|

▪

|