International transactions > Setting up multiple currencies > Task 3: Create accounts to track foreign‑currency transactions

Task 3: Create accounts to track foreign‑currency transactions

In order to track transactions in a foreign currency, you must create accounts that use that currency. You cannot use the same accounts that you use for your local currency transactions because your currency and other currencies rarely trade at par with one another (that is, one New Zealand dollar rarely buys exactly one monetary unit in any other currency).

Only balance sheet accounts—asset, liability and equity accounts—can be assigned a foreign currency. All other types of accounts are tracked using Australian dollars.

For every foreign currency account you create, you need a linked exchange account. For example, if you create a yen cheque account, you need a yen exchange account. Together, these accounts allow the foreign currency amount and the local currency equivalent to be viewed in your balance sheet.

When you create a foreign-currency account, you can let your software create the linked exchange account, or you can specify one yourself.

If you make foreign sales

Following is a list of the accounts you are likely to need if you accept payment from customers in a foreign currency.

|

▪

|

Asset account for tracking receivables (for instance, ‘Receivables Accounts Euro’). This account must be assigned the foreign currency and not your local currency.

|

|

▪

|

Bank account where customer receipts in the foreign currency will be deposited. This can be your local currency account if your bank accepts deposits in other currencies.

|

|

▪

|

Liability account for deposits received (if you allow customers to make deposits on orders). This account can be assigned the currency code for either the foreign currency or your local currency.

|

Only receipt transactions that are in your local currency can be grouped with undeposited funds. Therefore, you can only use your New Zealand dollar currency account as the linked account for undeposited funds.

Following is a list of accounts you are likely to need if you make payments to suppliers in a foreign currency:

|

▪

|

Liability account for tracking payables (for instance, ‘Payables Accounts Euro’). This account must be assigned the foreign currency and not your local currency.

|

|

▪

|

Bank account that will be used to pay debts in a foreign currency. This can be your local currency account if your bank writes cheques for you in other currencies.

|

|

▪

|

Asset account for deposits paid (if you make deposits on orders). This account can be assigned the currency code for either the foreign currency or your local currency.

|

|

▪

|

Liability account for import duties collected (if you're required to pay duty on goods you import). This account can be assigned the currency code for either the foreign currency or your local currency.

|

If you plan to track unrealised gains and losses, you need to create an income account for this purpose. You may want to name it ‘Unrealised Currency Gain/Loss’ or something similar. We recommend that you consult your accountant to determine whether your business needs to track unrealised gains and losses and, if it does, the most appropriate way for it to do so. See Tracking currency gains and losses for more information.

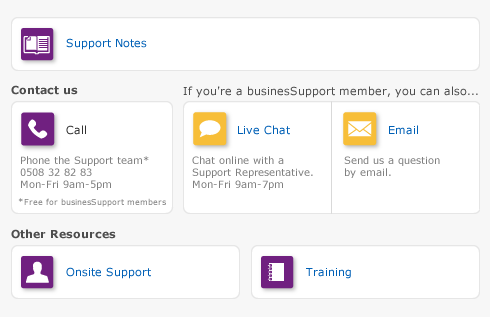

Depending on your business, you may need to create additional accounts to track foreign bank accounts, assets held overseas and the like. If you are unsure about the accounts, ask your accountant or an MYOB Approved Partner.